The Definitive Guide To Real Estate Investing

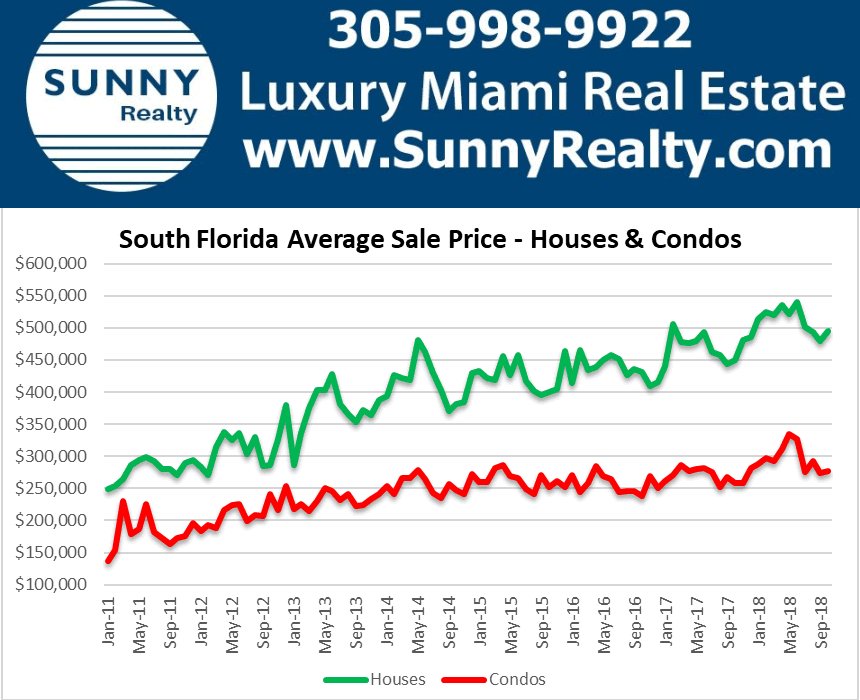

The housing prices keep increasing year after year,

sometimes by just few percent, sometimes into double digits, but nevertheless, it

always increases in some parts of the country, mainly in the big coastal cities

such as San Francisco, New York, New Jersey, Los Angeles, Miami, Washington DC,

etc. The growth may be due to low mortgage rates, high demand which causes

tightening inventories and sometimes because of the growth and popularity of

the city.

GoBankingRates recently published that Buffalo, New York gained over 34%. Atlanta, Georgia is another example of an unprecedented growth – over 24.5% and Cincinnati, Ohio grew by over 20%.

The one thing is always true when it comes to US real

estate – it will keep growing year after year, like it has done since the

beginning of the history.

Some cities experience steady growth year after year,

like San Francisco, California, others keep spiking up and down, like

Manhattan, New York. Some will take you on a roller-coaster ride, like Miami,

Florida. Nevertheless, the time to invest in US real estate is now and the

market presents great opportunities.

Leon Bell is one of the sharpest real estate brokers specializing in Miami's residential and commercial real estate since 2003. After serving as a vice president of One Sotheby’s International Realty and managing his own top-producing office in Sunny Isles Beach for over 4 years, Leon had launched his own brand - Sunny Realty. Leon is a new generation of technologically advanced realtors possessing in-depth knowledge of the local real estate markets. Because of Leon’s technological background, he is capable of delivering unique, sensitive and valuable real estate information to his clients in a shortest period of time. Leon feels that the information is the only tool that will help his clients to achieve their real estate goals.